Despite its limitations, 2022/23 Crop Plan fosters the adoption of sustainable practices valued in the Brazilian coffee top destination markets.

Every crop year beginning is marked by the launch of a new Crop Plan – a government program that directs public funds to the promotion of agricultural production. Following the last few years trend, the 2022/23 Crop Plan reinforces the incentives for the development of a greener and more competitive agribusiness, through the adoption of decarbonizing practices, technological innovations that increase productive efficiency, and the improvement of risk management, mitigating the impacts of climate change and promoting food security.

The new Crop Plan is in tune with the social dimension of sustainability, given its focus on small farmers, who are the most representative in coffee production in Brazil – 78% of coffee growers are family farmers and qualify for credit lines under the National Program to Strengthen Family Agriculture – Pronaf¹.

In the 2022/23 crop year, BRL 53.6 billion will be made available for these farmers, representing a 36% increase compared to the volume of resources made available in 2021/22.

The supply and access to credit are important components to enable a living income for small farmers, as they provide rural families with the opportunity to acquire inputs, access new technologies, and develop resilience to external shocks, whether economic or climatic. Specifically in relation to climate change adaptation, the Pronaf ABC+ Bioeconomy credit line now also finances the adoption of soil-water-plant conservation practices and integrated production systems, such as Crop-Livestock-Forest (ILPF).

Regarding the implementation of the sectorial policy to face climate change in agriculture and livestock (ABC+ Plan), the 2022/23 Crop Plan directed the largest volume of resources in history (BRL6.19 billion) to investments in practices that increase productive efficiency and conserve soil, water, and vegetation, increasing carbon sequestration from the atmosphere. In comparison with the previous agricultural year, fund supply for such purpose grew 22.5%.

Among the several items financed by the ABC+ Plan credit lines are green manure, the planting of soil cover crops, and the construction of facilities for the implementation or expansion of bio-input and bio-fertilizer production units on rural properties for their own use. The application of these inputs and practices in coffee farming was evaluated in a recent study promoted by Cecafé, in partnership with Imaflora and Professor Carlos Eduardo Cerri (Esalq/USP), which proved that their adoption makes the coffee carbon balance even more negative, by 10.5 tons of CO2eq per hectare per year.

Credit expansion for investment in such practices and others, such as integrated systems, is an important incentive for Brazilian agribusiness to reach its decarbonization potential, contributing to the global confrontation of climate change.

The carbon market has grown to an estimated USD 270 billion in the last year, putting it on the radar of institutional investors as an asset of interest. Coffee production systems in Brazil fit the interest, with the sustainability of its systems and productive environments.

Financial markets have been recently influenced by investors, companies, and governments to also strive to limit the effects of climate change. Consequently, the carbon market is expanding rapidly. Credits are now tracked and traded like any other commodity, with a market potential to become an importante driver of global economic decarbonization by pricing carbon and encouraging polluters to reduce their emissions.

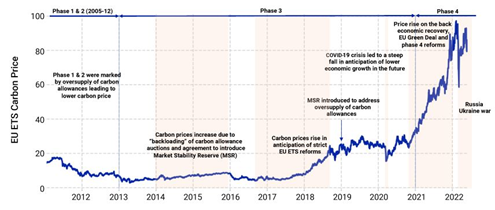

Figure 1 – Evolution of carbon

prices of the Europe Union –

Emissions-trading systems (ETS)

presented in four phases of market

development. Source: MSCI 2022

(https://www.msci.com/www/

blog-posts/introducing-the-carbonmarket/

03227158119).

The role of digital agriculture is also important, integrating different systems, tools, and technological solutions to rationalize inputs and achieve greater production and energy efficiency.

In the 2022/23 crop year, farmers will be able to access credit for investments in field connectivity systems, software and licenses for management, monitoring, or automation of production activities. Through the Incentive Program for Technological Innovation in Agricultural Production (Inovagro) it will also be possible to finance systems for the generation and distribution of energy produced from renewable sources.

Managing risks in agricultural activity is another key component of a more sustainable agricultural policy. Regarding coffee, the Subsidy Program for Rural Insurance Premium (PSR) plays an important role in leveraging the use of risk management tools, offering a 40% premium subsidy. In the crop year that started in July, coffee farmers will still be able to access the benefit. Innovation is the program’s link to low carbon agriculture. For farmers who join the ABC+ plan, the subsidy will increase to 45%, an important incentive to the adoption of conservationist practices that promote greater resilience of rural properties to bad weather.

Cecafé, as the legitimate representative of the coffee exporting segment, begins the 22/23 crop year with a focus on maximizing the benefits offered by sectorial public policies through its programs, such as the Informed Farmer, aimed at training small coffee farmers. Also, issues related to tackling climate change, fostering digital coffee farming, and rationalizing inputs are on the radar of its Social Responsibility and Sustainability Pillar.

With the support of an agricultural policy connected to global challenges and focused on ESG practices, Brazilian coffee is strengthened to remain at the forefront of global sustainability.

1 Source: Censo Agropecuário 2017, conducted by Instituto Brasileiro de Geografia e Estatística (IBGE).

Marcos Matos

CECAFÉ CEO

Silvia Pizzol

CECAFÉ Sustainability Manager

Leave A Comment