ESG strengthens as a strategy to access markets and Brazil’scoffees are well positioned to stand out in the trend.

The international export market scenario for agribusiness products, still impacted by the consequences of the Covid-19 pandemic and the conflict between Russia and Ukraine, becomes increasingly challenging. Amidst the concern with the global climate crisis, and even in the face of uncertainties related to food security, geopolitical risks, and global recession, Environmental, Social and Governance (ESG) has been strengthening as a factor for competitiveness and market access.

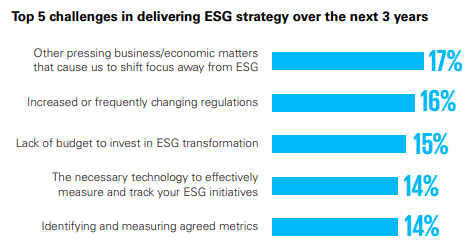

A recent study by KPMG International 1 surveyed the outlook and strategies of 1,325 global CEOs in 11 markets for the future of their business over the next three years. Regarding Environmental, Social and Governance (ESG), an increasing number of CEOs agree on its positive impact on business financial performance (45% of CEOs compared to 37% in 2021).

In addition, the CEOs’ number one strategy to mitigate supply chain issues is to monitor more deeply the environmental, social, and governance practices of their partners and suppliers to better anticipate risks to their companies’ reputations. In their plans, the strategy relates to digital transformation – 74% say that their organizations’ digital and ESG strategy investments are intrinsically linked.

Source: KPMG 2022 CEO Outlook

The goal is to report to consumers and investors on where the raw materials used by the companies originate and the record of compliance to human rights and environmental rules by their suppliers.

While recognizing that ESG is intrinsic to the long-term financial success of companies, the risks of a global recession are likely to slow down some of the plans in the area. The study show that 50% of CEOs are pausing or reconsidering their existing or planned ESG efforts for the next six months, and 34% have already done so.

The KPMG report warns that delaying key ESG efforts may cause companies to become more reactive in the future, rather than helping them lead a market with greater transparency, resilience, and sustainability.

In this context, Brazil, as the world’s leading coffee supplier, is well positioned in terms of competitive advantages related to Environmental, Social and Governance. Brazilian coffees are a successful story regarding sustainability, as they evolve based on science and with the support of an organized production chain, aimed at the export market. The combination has resulted in undeniable gains in competitiveness, such as the significant leap in Brazilian coffee productivity, from 9 coffee bags/ha in the 1990s to approximately 30 coffee b ags/ha today.

In other words, there is productive efficiency in Brazil, result of the intensification of sustainable practices that thinks through resources and makes environmental conservation feasible. According to a study conducted by Embrapa Territorial, based on CAR data, there are 43.9 million hectares of preserved native vegetation within the rural properties of the country’s main coffee-growing states.

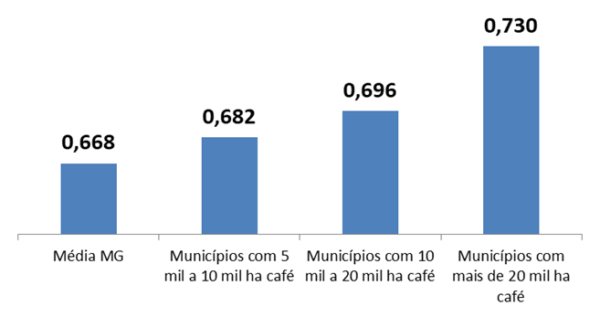

Average HDI of Minas Gerais municipalities grouped according to coffee-growing area

Sources: Human Development Atlas in Brazil and PAM/IBGE

Combining efficient production and environmental preservation, Brazil continues to lead the world coffee exports, exporting to more than 120 destinations, generating foreign Exchange revenue of around USD 8 billion and, consequently, development for the nation. In Minas Gerais, for example, the main coffee producer state, the larger the cultivated area, the higher the Municipal Human Development Index (HDI)—and it is always above the state average.

Acting proactively in the face of new challenges in global export market, Cecafé has been developing projects and engaging in collective actions, both to advertise the sustainability of Brazilian coffees and to promote its continuous improvement.

Cecafé’s Code of Ethics and Conduct expresses the commitment to transfer ethical principles and respect for strict Brazilian legislation to the supply chain, which extends to associate members, reinforcing governance within the scope of ESG practices.

In the environmental scope, in which climate change and commitments to reduce greenhouse gas emissions are predominant concerns, Cecafé has shown to the world that Brazilian coffee growing is sustainable because it sequesters rather than emits carbon. The scientific research, conducted by Imaflora and by Prof. Carlos Eduardo Cerri, from Esalq/USP, also shows the potential connection with the carbon market, considering that “decarbonizing” practices reach an additionality of -3.79 tons of CO2eq per ton of green coffee produced.

To strengthen good environmental and social practices, Cecafé joins forces with its members and partner councils to promote the responsible use of agrochemicals and social welfare in coffee communities. An important action resulting from the initiative will be the modernization of council’s “Informed Farmer” program, with digital inclusion, awareness, and consequently more competitiveness to coffee growers.

The coffee exporting industry is aware of global challenges and is acting proactively to increasingly integrate ESG practices into the supply chain. Combining quality production, environmental conservation, strict social rules, science, and innovation, Brazil remains the leader in the global coffee export market, supplying more than a third of the coffee consumed worldwide with quality and sustainability.

[1] https://assets.kpmg/content/dam/kpmg/xx/pdf/2022/10/ceo-outlook-report.pdf

Marcos Matos

CECAFÉ CEO

Silvia Pizzol

CECAFÉ Sustainability Manager

Leave A Comment