Despite the good volume shipped this year, exporters continue to face logistical bottlenecks and have accumulated losses of BRL 9 million in extra costs;

By not sending this coffee abroad, Brazil missed out on BRL 3.2 billion in foreign exchange earnings

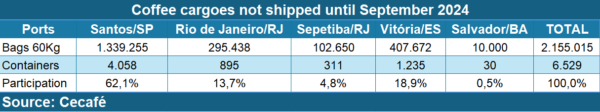

A study conducted by the Brazilian Coffee Exporters Council (Cecafé) among its members shows that the delays and frequent changes in the export schedule have resulted in a backlog of 2.155 million coffee bags, or 6,529 containers, of the product up to September 2024. At an average FOB price of USD 269.40 per bag (green coffee, Sept/2024) and an average dollar exchange rate of BRL 5.5410, this means that the country has missed out on USD 580.55 million or BRL 3.217 billion in foreign exchange earnings.

According to Cecafé’s technical director, Eduardo Heron, the scenario becomes even more critical when one considers the losses coffee exporters are incurring due to the lack of adequate port infrastructure for containerized cargo.

“Our members reported additional costs of BRL 5.938 million due to detentions, additional storage, pre-stacking and early gates, caused by the high rate of delays and recurring changes in ship calls. These bottlenecks show that our ports have not developed at the same pace as the agro-industry. The ports are inadequately structured for containerized cargo, revealing an overburdened infrastructure and the need to increase the capacity of shipyards and berths, as well as deepen the draught to accommodate larger vessels,” he says.

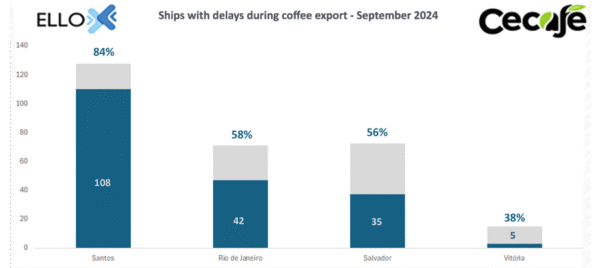

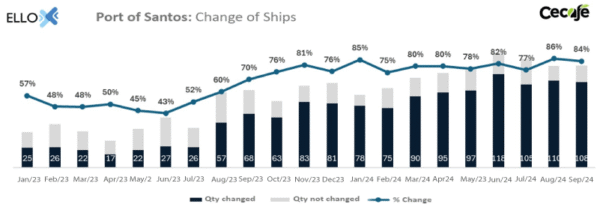

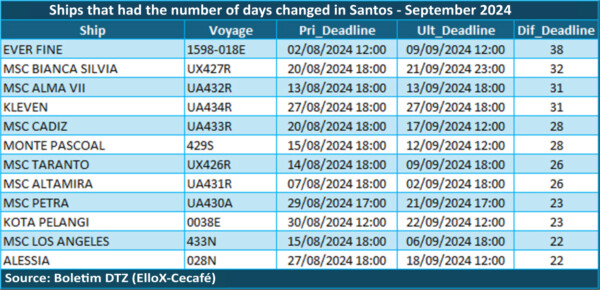

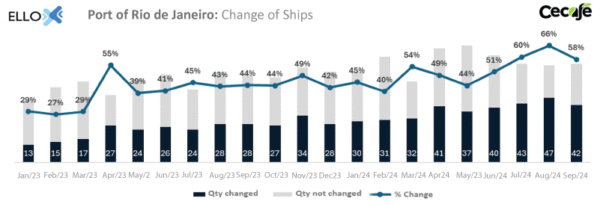

According to the Detention Zero Newsletter (DTZ), prepared by the startup ElloX Digital in partnership with Cecafé, in September alone 69% of the vessels, or 190 out of a total of 277 ships carrying coffee, had their schedules changed or delayed in Brazil’s main ports. The longest waiting period was 38 days between the setting of the first and last deadlines, recorded at the Port of Santos (SP).

The survey shows that the Port of Santos, the main terminal for shipping Brazilian coffee abroad, recorded an 84% delay rate for container ships in September, affecting 108 out of a total of 129 vessels.

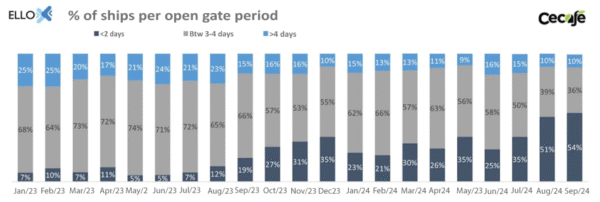

Only 10% of shipping procedures had a gate opening timeframe of more than four days at the Port of Santos last month. Another 36% had between three and four days, and 54% had less than two days.

“The number of vessels with gates open for less than 48 hours reached its worst level since January 2023, when we started the survey, and even more worrying is the fact that 42 vessels did not even have their gate open, adding to the scenario of additional and high costs for exporters,” says Heron.

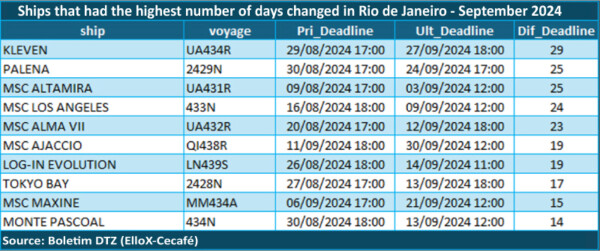

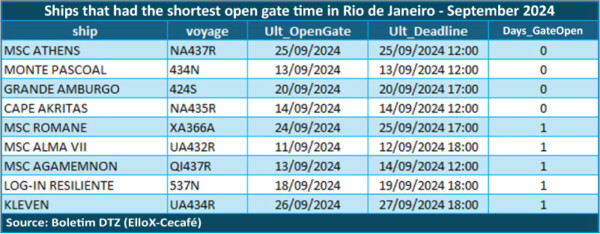

At the port complex of Rio de Janeiro (RJ), Brazil’s second largest coffee exporter, the rate of ship delays last month was 58%, with the longest gap between the first and last deadline being 29 days. This percentage means that 42 of the 72 ships carrying coffee had a change of port of call.

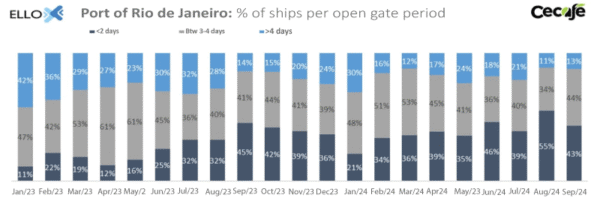

Also in September, 13% of vessels in Rio de Janeiro had an open gate of more than four days, 44% had between three and four days, and 43% had less than two days.

Heron emphasizes that the growth in containerized cargo shipments reveals the lack of adequate infrastructure in Brazilian ports and its impact on foreign trade, causing problems such as the addition of logistical costs to exports, reduced transfer of FOB value to farmers and, more recently, problems with the issuance of phytosanitary certificates for certain destinations due to delays and changes in stopovers.

“Thanks to the competent and tireless work of the logistics teams of the coffee exporters, together with the support and cooperation of some port terminals, Brazil has been able to meet its commitments, despite the high logistics costs. However, it is very important that the authorities are aware of this scenario and promote a broad dialog so that we can continue to supply our customers and avoid further losses in exports,” he says.

RELIABLE EXPORTER

The president of Cecafé, Márcio Ferreira, praises the commitment of Brazilian exporters to their international customers, giving up a good part of their margins, bearing the extra costs caused by bottlenecks and honoring their commitments.

Brazil exported 4.464 million coffee bags in September 2024, a record volume for the month and an increase of 33.3% compared to the 3.348 million bags shipped in the same period last year. From January to September this year, Brazil exported a record of 36.428 million bags, an increase of 38.7% on what was recorded in the first nine months of 2023.

“Our members have shown their ability to overcome challenges. Despite the various logistical bottlenecks, the sector has shown clear signs of being able to set new export records in practically every month of this year, and this is making the relationship between importer and exporter more and more solid due to the punctuality in fulfilling contracts on FOB terms,” he says.

Marcos Matos, general director of Cecafé, shares this view. He points out that despite logistical bottlenecks, Brazil’s coffee exporters are committed to supplying coffee to the world’s most diverse and demanding markets.

“We are showing that we can work two, three, four, five times harder and get our coffee to the entire global consumer market. Despite the difficulties, we are able to persevere in the face of adversity, guarantee delivery and continue to break records,” he says.

Matos says that Cecafé remains committed to the infrastructure and logistics agenda, maintaining dialogue at all levels of government and with private sector players, and organizing work between agribusiness organizations and representatives of shipping companies and port terminals.

Ferreira adds that the ability to connect with the main players in logistics will continue to evolve, through transparent debates that “bring to the table” those who can have a positive influence, such as Cecafé and the other Brazilian coffee associations, as well as representatives of importers, shipping companies, terminals, port authorities and federal, state and municipal governments.

“With growing production, suitable climatic conditions, strong demand and competitive, fair and remunerative prices for our farmers, we have no choice but to find solutions so that the most diverse, high-quality and sustainable coffees in the world can reach more and more of the millions of consumers who love Brazilian coffees so much,” he says.

Coffee exporters who would like to subscribe to the Detention Zero Newsletter can sign up at https://app.pipefy.com/public/form/-SYfpMNK. Once you have registered, ElloX will give you instructions on how to obtain information from the terminals.

Leave A Comment