In recent times, geopolitics has been at the center of both domestic and international discussions and demonstrations.

The term refers to the relationships and power struggles among countries, including diplomatic, political, and territorial conflicts; the historical evolution of global political organization; and the activities of international organizations and economic blocs.

A key tool for analyzing international relations and territorial dynamics across different scales, geopolitics provides insights into historical developments and, above all, supports the formation of a critical perspective on current global affairs.

Holding the Brazilian flag in the wind.

A recent development was the announcement of new tariffs on imported goods by U.S. President Donald Trump, which has raised concerns about potential impacts on both the American and global economies.

As tariffs rise, major banks have adjusted their forecasts and raised the risk of a U.S. recession, triggering sharp declines in global stock markets and prompting retaliatory responses worldwide.

Additionally, the World Trade Organization (WTO) estimates that the tariff increases could reduce global trade by 1% in 2025.

As a result, there is growing concern that the overall balance may be negative, driven by heightened global uncertainty and risks to economic growth—factors likely to affect Brazil’s economic activity.

According to analysts, emerging markets like Brazil—and sectors such as aerospace, meat processing, and agribusiness—could be affected by a potential drop in U.S. demand.

Adding to this are new trade flow regulations established in recent years, focused on socioenvironmental governance criteria, which have been at the core of both domestic and international debates and initiatives.

Adopted by the European Union (EU)—a market that absorbs nearly 50% of Brazil’s coffee exports—these regulations have begun impacting supply chains of companies within the bloc and affect agricultural commodity producers, including Brazil’s coffee regions.

Among these new regulations are the 2023 European Union Regulation on Deforestation-Free Products (EUDR), the Corporate Sustainability Due Diligence Directive (CS3D), and the regulation banning goods produced with forced labor, both approved in 2024 and set to take effect in 2027, in addition to other measures included in the European Green Deal.

Brazil is the global leader in the coffee market, ranking as the largest producer and exporter, and the second-largest consumer of the beverage. Given this context, the industry faces increased risks, calling for stronger, unified strategies from both producers and public institutions.

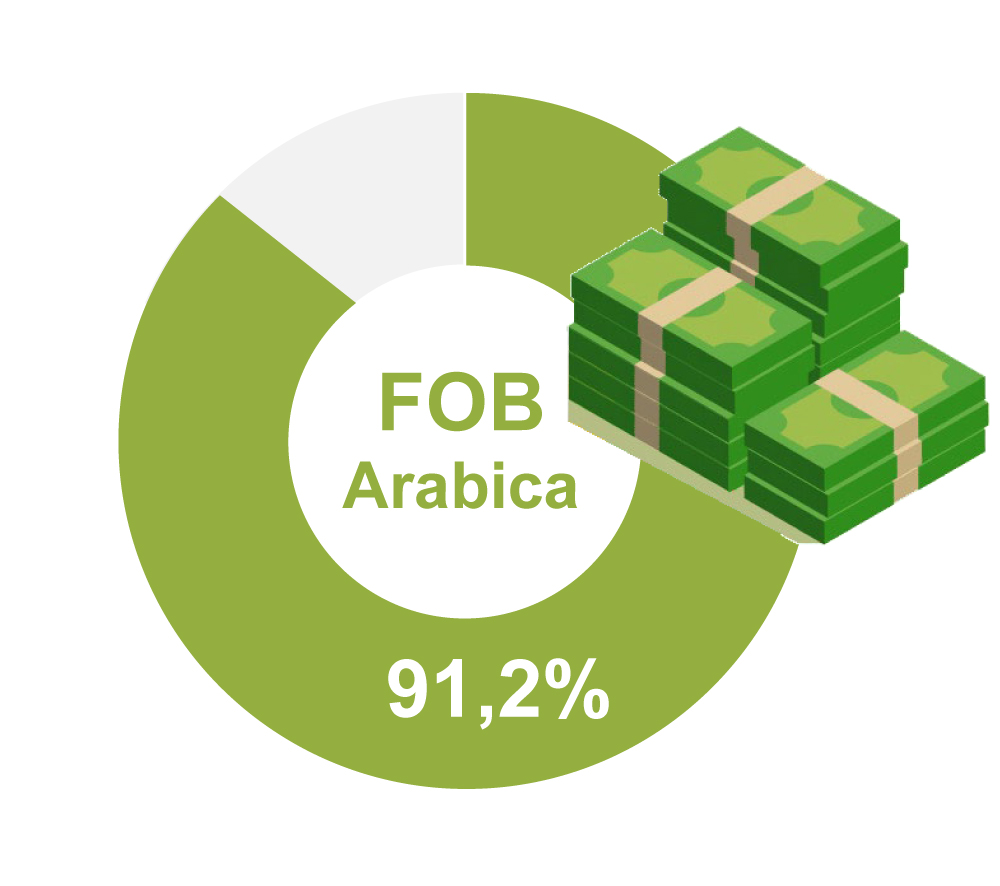

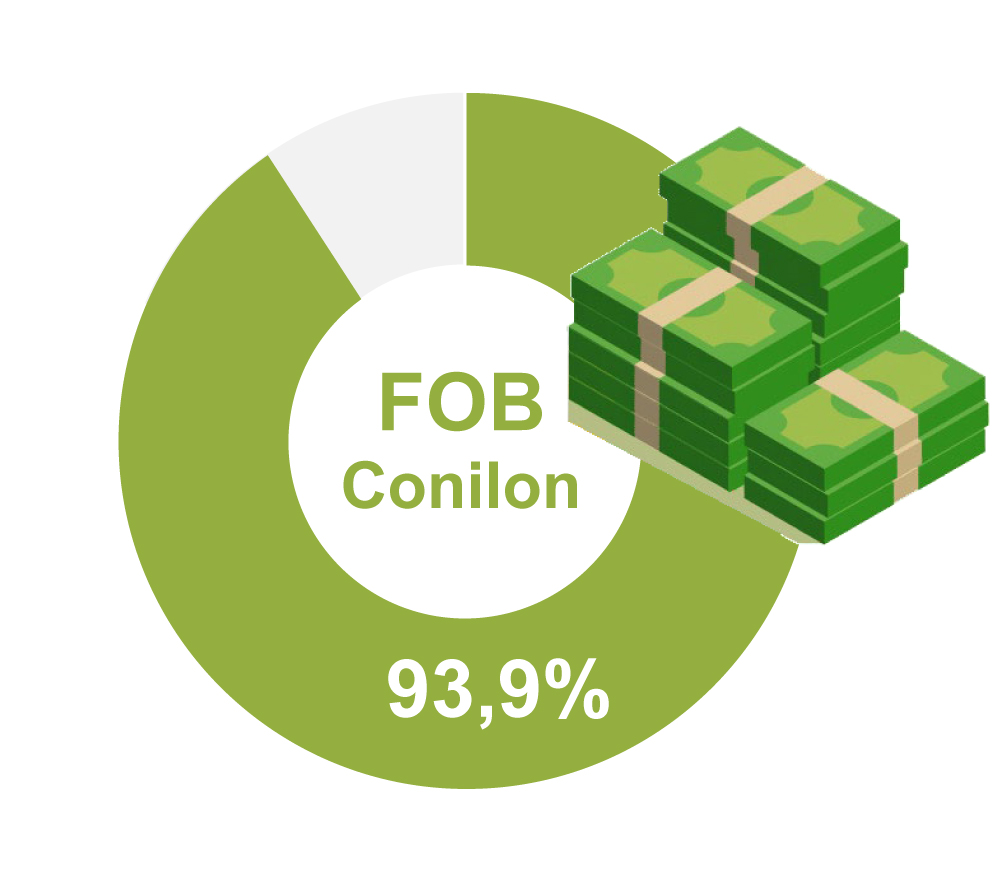

“Cafés do Brasil” are based on sustainability, diversity, quality, and credibility. The sustainability and efficiency of Brazil’s coffee sector are demonstrated by data from IPEP—the index that measures the Free on Board (FOB) price transfer from exports to growers—and by the analysis of the Human Development Index (HDI), which reflects longevity, education, and income in producing regions, along with carbon balance in coffee production and regenerative agriculture, among other indicators.

According to IPEP/CECAFÉ, between 91% and 94% of export prices are transferred to producers of Arabica and Conilon coffee, respectively. The efficiency level of Brazil’s coffee export trade results in sustainable income for Brazilian growers and greater resilience in the face of challenges.

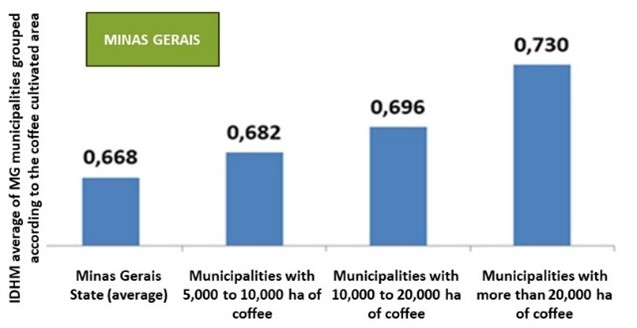

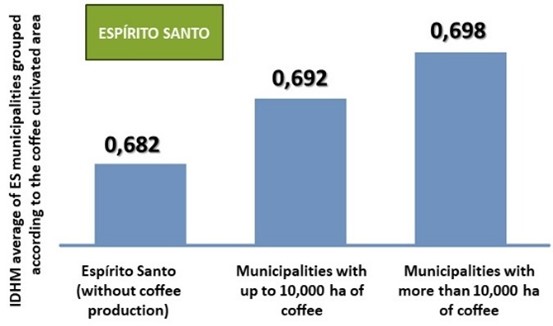

The analysis reveals a positive correlation between coffee cultivation area and the MHDI. In other words, the larger the coffee-growing area in a municipality, the higher its Human Development Index.

To promote greater transparency and efficiency in monitoring socio-environmental compliance—particularly in relation to deforestation risks across Brazil’s coffee supply chain, as required by the EUDR—Cecafé launched the Coffees of Brazil Socio-Environmental Monitoring Platform, developed by Serasa Experian. Operated by Cecafé, the platform currently includes over 56 member companies—national, international, and cooperatives—that together represent approximately 99% of Brazil’s coffee exports to the European Union.

The platform provides updated information from hundreds of public and official databases that assess and monitor socio-environmental issues in compliance with national legislation for roughly 260,000 coffee growers. It generates appropriate, conclusive, and verifiable evidence to meet the requirements of the EUDR, with an emphasis on Article 9 of the regulation.

The tool produces digital reports and other data for importers’ platforms, which are responsible for submitting Due Diligence documentation to EU systems.

In other words, Cecafé’s proactive engagement and that of its members result in key partnerships, complementary strategies, and reduced risks to global coffee trade flows. In addition, the monitoring tool presents technical and auditable evidence that confirms an insignificant deforestation risk for Brazilian coffee exported to the EU.

For this reason, global geopolitics, sustainability in the coffee supply chain, and new trade flow regulations, among other topics, will be addressed in dedicated panels at the 10th Coffee Dinner & Summit-one of the world’s leading coffee industry events—hosted by Cecafé from July 2 to 4 at the Royal Palm Hall in Campinas (SP), under the theme “The Future of Trade Flow: Influence and Leadership of Brazilian Coffees”.

The 10th edition of the Coffee Dinner & Summit is being carefully prepared to bring together national and international coffee sector stakeholders to foster business, share insights, and connect enthusiasts in a spacious, welcoming new venue.

More information at: https://coffeedinner.com.br/

Marcos Matos

CECAFÉ CEO

Silvia Pizzol

CECAFÉ Sustainability Director

Leave A Comment